The global economy’s future often hinges on the accuracy of economic forecasting. Recession indicators aim to hint when downturns may come. Yet, the tricky task of forecasting the exact start of the next recession remains. Looking at past events, we see big misses in predictions, like the 2001 recession and the Great Recession’s depth.

Economics is always changing and views business cycles as effects of demand and supply shocks. These shocks, from policy errors or unforeseen events, make predictions hard. With the complexity of economic systems, we wonder if forecasting is just guesswork or if it’s somewhat accurate.

Key Takeaways

- The AUROC is key for checking how precise recession predictions are.

- Data from Treasury yields and the Federal Reserve help us grasp economic forecasting.

- Models focused on yield curves are good at signaling recessions.

- Short-term forecasts are more accurate using financial indicators like the Treasury yield curves and the Conference Board Leading Economic Index.

- Long-term indicators lose some accuracy as they project further into the future.

- The US economy’s evolution shows how various indicators’ accuracy changes over time.

- Using different indicators together improves the dependability of medium-term forecasts.

The Unpredictability of Economic Downturns

Modern economics is a complex field where predicting downturns is vital but hard. We look at why forecasting these events is so tough and what unpredictable factors play a part. These factors make the economic future hard to predict.

Why Forecasting is Challenging

Forecasting business cycles comes with big challenges. Economists use the yield curve as an indicator of downturns. But this tool isn’t always right. Policy changes can also make predictions less accurate.

Predicting downturns means looking at economic signs that can be unclear. This makes forecasting more of an art than a science. Economists must interpret complex signs that sometimes conflict.

Random Events and Their Impact on Accuracy

Unpredictable events like geopolitical crises can complicate economic forecasts. Shifts in market behavior can change how well tools like the yield curve work. It’s hard for models to account for these unpredictable factors.

Tools like probit models try to predict recessions by looking at yield-curve spreads. But their accuracy drops when looking far ahead. This highlights how unpredictable the economy can be. Random events play a big role in this unpredictability.

Unpredictability in economics shows the limits of our forecasting methods. Despite advances, unforeseen events and business cycle complexities challenge our accuracy. This continues to be a hurdle for economists.

Economists’ Track Record in Predicting Recessions

Exploring how well economists have predicted recessions is very telling. It shows how reliable economic prediction records are. The forecast accuracy is key due to the global economy’s complex nature. Let’s look into recessions prediction data and unforeseen economic shocks.

Historical efforts to predict recessions were often off the mark. This was especially true when models didn’t include central bank errors or financial market effects. These mistakes led to wrong predictions.

Historical Data on Forecast Accuracy

Making economic forecasts, including recession ones, has always been tough. The percentage of accuracy in economic predictions related to recessions varies a lot. It depends on when the forecast was made and the economic situation at the time. Predicting downturns is hard, say experts, due to many global economic factors.

| Indicator | Accuracy in Predicting Recessions |

|---|---|

| LEI Year-over-Year Percent Change | Highly Effective Since 1970s |

| Unemployment Claims | Early Indicator (Varies) |

| Manufacturing Orders Decline | Early Indicator (Reliable) |

The Role of Unforeseen Shocks

Unforeseen economic shocks greatly affect prediction accuracy. When things like geopolitical tension, financial crises, or pandemics happen, they mess up forecasts. These events add confusion to forecasting, showing the need for better models.

To wrap up, even though economic prediction records are getting better thanks to data and modeling advances, the unpredictability of unforeseen economic shocks and central-bank mistakes still makes recessions prediction data hard to nail down. We must keep improving our methods to make better predictions and lessen the effects of financial surprises.

How Accurate Do You Think Economics Are at Predicting Recessions?

When looking into economic prediction reliability, especially about recession forecasting, we must consider its real-life accuracy. The global economy’s complexity and various influencing factors make predicting economic cycles challenging.

Studies by giants like J.P. Morgan have shown that financial signs often signal looming downturns. For instance, the difference in yields between ten-year and two-year U.S. Treasury has reliably forecasted recessions since the 1970s. This inversion is a key sign used in recession forecasting.

The probit model, which analyzes yield-curve spreads, successfully forecasts downturns. It reliably signals an upcoming recession. This indicates a strong relationship between yield curve behaviors and economic downturns, highlighting economic forecasting effectiveness.

While deep financial insights help in forecasting, unforeseeable market and political events can lessen economic prediction reliability. Market expectations about future monetary policies, shown in forward rates, also play a significant role. The match between U.S. Treasury forward rates and recessions suggests how market expectations influence recession forecasting.

Changes in yield curve factors like expected inflation and real interest rates impact recession prediction accuracy. These factors mirror the broader economic atmosphere and are affected by new data and global developments.

Although tools and models aid in predicting downturns, their effectiveness varies with the global economy’s shifting nature. Thus, experts and investors should be cautiously optimistic about economic forecasting effectiveness. They must always look for the latest and most detailed information for predictions.

It’s clear that sophisticated financial knowledge and models are key in forecasting, but achieving complete certainty in economic predictions is challenging, reflecting the constant changes in the economic environment.

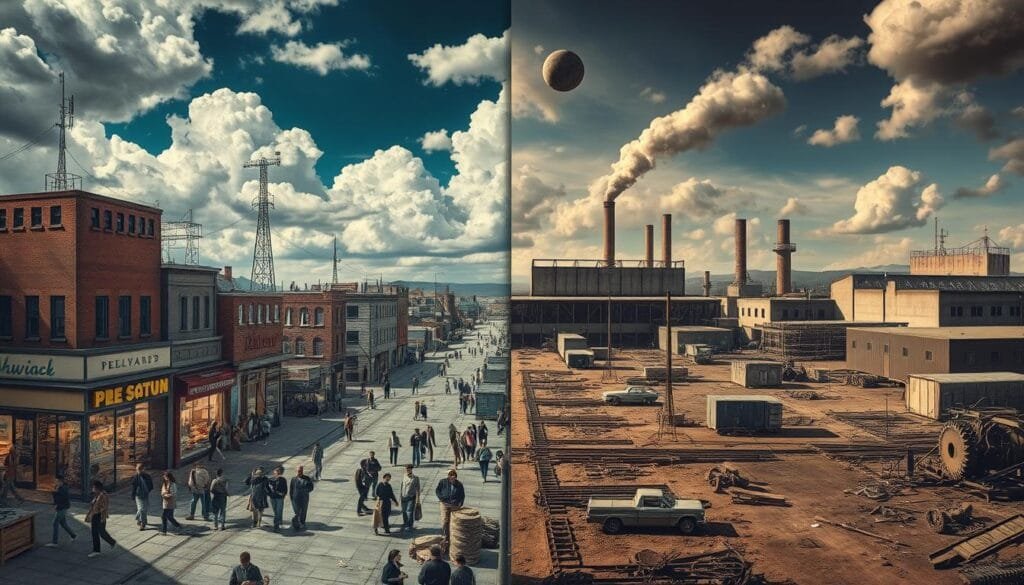

Demand Shocks vs. Supply Shocks

Understanding the differences between demand and supply shocks is key to grasping economic impacts. Demand shocks happen when the need for goods and services suddenly changes. Supply shocks occur with unexpected shifts in how much goods and services are available. These shocks affect the economy in big ways, influencing how policymakers and leaders fix problems caused by things like income losses or credit issues.

Understanding the Differences

Electric vehicles are a perfect example of demand shock. Companies such as Tesla Motors have increased demand in the market. On the other hand, supply shock was clear during the COVID-19 pandemic. Manufacturing and supply chain problems deeply affected many industries.

Grasping these economic shock differences is practical, not just theoretical. It shapes how governments and companies deal with crises. For example, the U.S. government’s stimulus checks during COVID-19 aimed to increase spending and help the economy recover. Such strategies are vital for lessening the immediate impacts of these shocks.

Examples and Their Effects on the Economy

Look at lithium prices surging because of electric vehicles needing more batteries. This shows both a demand shock and supply issues in mining. The mining sector struggles to meet the high demands.

Supply problems can trigger a chain reaction. A lack in industrial parts may stop production. This causes a shortage in stores and leads to losses in income in different areas. This shows how complex it is to handle economic shocks.

Distinguishing demand from supply shocks is crucial. It tells us much about the economy’s health. Knowing if the issue is more about demand or supply helps create better policies. Such steps are vital for keeping economies stable during hard times.

Short-term vs. Long-term Predictions

Understanding short-term and long-term economic forecasts can guide our decisions. Data like yield-curve inversions are crucial for predicting recessions in the short term. In fact, they’ve indicated all six recessions since 1977. But, as we look further ahead, these predictions become less reliable.

Accuracy in Immediate Future Predictions

Short-term forecasts are more reliable because of up-to-date economic indicators. According to Bloomberg, there’s a 60% chance of a recession in the next year. This forecast is based on recent economic changes and Federal policies, showing that immediate predictions have a certain precision.

The Decline in Precision Over Time

Long-term forecasts face more uncertainty as they look further ahead. Factors that affect forecast accuracy increase, making long-term predictions less reliable. Financial cycle measures, for example, vary in accuracy across different countries and times. This variation underscores the challenges of making long-term recession forecasts.

Here’s a comparative analysis of forecast precision over time:

| Forecast Type | Precision Metric | Typical Use Case |

|---|---|---|

| Short-term Economic Forecasts | Higher Accuracy | Immediate financial decisions, risk assessment |

| Long-term Economic Forecasts | Lower Accuracy | Strategic planning, policy making |

Improving the precision of economic forecasts is key. We need to keep refining our methods and models. Doing so helps not just with predicting recessions but also in navigating the wider economic environment.

External Factors Influencing Economic Predictions

We’re looking into how accurate economic forecasts can be. It’s crucial to see how outside factors play a big role. Things like what central banks do and big global events are key. They really shape how these predictions turn out.

The Role of Central Banks and Monetary Policy

Central banks have a big effect on economic forecasts. They try to control economic growth and inflation by changing policies. This can either trigger a recession or help stabilize things. For example, changing interest rates greatly affects economic activity. It can make the economic outcome either more unpredictable or stable.

Looking back at recent tough times, forecasts on GDP growth and unemployment rates were often way off. Taking 2008 as an example, forecasts missed the mark by a lot. GDP growth was way lower than expected. At the same time, more people were out of work than anticipated. In late 2009, this error in predicting unemployment rates meant over 6 million people were unexpectedly without jobs.

Global Events and Their Unpredictable Outcomes

Global economic events are hard to predict and can mess up economic forecasts. Disasters, political changes, or pandemics like COVID-19 shake up the usual economic patterns. They make it really hard for standard forecasts to be right.

During COVID-19, for example, GDP forecasts couldn’t catch up with the real economic shock, especially unemployment spikes. This shows we need forecasting models that can adapt quickly to sudden economic changes.

Even in stable economies, it’s hard to get forecasts right, as seen with inflation rates post-2020. For example, the Bank of England predicted a much lower inflation rate for 2022 than what actually happened. They said it would be 3.4%, but it jumped to 9.2%.

| Year | Forecasted Inflation | Actual Inflation |

|---|---|---|

| 2022 | 3.4% (UK) | 9.2% |

| 2022 | 3.2% (Eurozone) | 9.2% |

This deep dive not only corrects past mistakes in forecasts but also teaches us important lessons. We’ve seen how big a part central banks and world events play in economic results. By fitting these factors into our models, we’ll get better at predicting the economy and understanding its future moves.

Psychology’s Role in Economic Forecasting

It’s crucial to understand how investor psychology and market behavior interact. This interaction helps us improve economic predictions. We need to mix human behavior insights with data analysis.

Investor Sentiment and Market Behavior

Investor feelings play a big role in market trends. They can make the economy stable or unstable. For example, before a downturn, yield spread takes into account investor sentiment, not just financial figures.

Fear and uncertainty can change what we expect from the market. These feelings can make the economy shift quickly. Traditional models might not catch these changes.

How Behavioral Economics Challenges Traditional Models

Behavioral economics adds complexity to how we predict economic trends. Biases affect our choices and the economy. It suggests using models that include psychological factors.

This field also makes risk assessment better by considering how psychology affects the economy. This way, forecasts get better and policy changes become more related to how people act.

Our prediction models must grow to include both data and human behavior insights. Working together across fields is key. Combining economics, psychology, and statistics leads to better understanding.

Here’s how adding behavioral insights makes our economic forecasts stronger and more thorough:

| Aspect | Traditional Models | Behavioral Economic Models |

|---|---|---|

| Data Utilized | Quantitative | Both Quantitative and Qualitative |

| Focus | Economic Indicators | Economic Indicators + Human Behavior |

| Response to Crisis | Generally Rigid | Adaptive and Dynamic |

| Risk Assessment | Primarily Economic Variables | Incorporates Psychological Factors |

| Interdisciplinary Approach | Limited | Encouraged and Integrated |

By mixing economic stability with human psychology, we understand market behavior better. This improves our economic predictions. Knowing about investor psychology enhances forecasting and helps policymakers.

Conclusion

Economic forecasting is a tricky field, especially when it comes to predicting recessions. Certain tools like the three-month/ten-year term spread and the Leading Economic Index (LEI) can help. But even with these tools, predicting downturns is tough. Our experience and studies show these challenges are real and affect our ability to forecast recessions accurately.

The current period of economic growth in the United States is record-breaking. However, even the best predictors have often been wrong about recessions. In fact, they missed several early 21st-century recessions. This shows we must be careful when looking at economic forecasts. They can vary a lot, especially regarding recessions between 2008 and 2012. Forecasters agree on some points but still struggle to predict downturns accurately. This shows we need to keep improving our methods.

We encourage you to learn more about the challenges of predicting recessions. A great starting point is the Philadelphia Federal Reserve’s discussion on the subject. You can find it here. As we look to the future, it’s key to stay cautiously optimistic about forecasts. Basic models and past data help, but they can’t fully grasp the complexity of the world’s economies. So, we must stay alert to the unpredictable nature of economic changes.

FAQ

How accurate is economics in predicting recessions?

Economists’ ability to forecast recessions can vary. Accuracy usually drops as their predictions stretch into the future. Though they can often spot signs of business downturns, complex economic elements can lead to unexpected results.

Why is forecasting economic downturns so challenging?

The challenge comes from economics being hard to predict. Unseen economic forces and mistakes in policy add to the difficulty. This makes forecasting recessions particularly hard.

What is the track record of economists in predicting past recessions?

In the past, economists haven’t been very good at predicting recessions. Their predictions have often missed the mark, especially with big downturns. This is usually because of sudden economic shocks they didn’t include in their forecasts.

To what extent do you think economics is accurate at predicting recessions?

We’re cautious about relying on economic forecasts. Though they can provide insight, their accuracy is limited by many unpredictable elements.

What are the differences between demand shocks and supply shocks?

Demand shocks pull back demand, causing economic downturns. Supply shocks interfere with credit and can limit borrowing and spending. It’s crucial to understand these shocks and their different impacts.

Are examples of demand and supply shocks and their effects on the economy?

Yes. For instance, supply shocks like jumps in energy prices can raise costs. Demand shocks include massive income losses or a drop in consumer spending. These can lead to recession.

How does the accuracy of short-term and long-term economic predictions compare?

Predictions in the short-term are often more precise, especially for spotting recessions. As time goes on, reliability decreases. The accuracy of long-term forecasts tends to get worse.

How do external factors influence economic predictions?

Factors like central banks’ decisions and monetary policy changes are important. They, along with global events, make predicting the economy harder.

What role does psychology play in economic forecasting?

Psychology and market feelings are key in forecasts. Things like the inverted yield curve show investor mood, hinting at downturns. Still, the unpredictable nature of people’s choices challenges old forecasting ways.